Border Adjustment Tax vs. Advantages of Manufacturing in Mexico

Border Adjustment Tax vs. The Unmistakable Advantages of Manufacturing in Mexico

In recent months, there has been talk about the US federal government implementing a border adjustment tax to address the problem of US companies outsourcing manufacturing jobs to Mexico. Yet Mexico offers US companies distinct and unmistakable advantages that will more than offset such a tax. Indeed, manufacturing in Mexico remains an extremely attractive option for many companies whose corporations benefit the US by offering their products at increasingly competitive rates.

The Proposed Border Adjustment Tax

The proposed tax is an attempt to address several concerns, and advocates believe this tax is the best avenue to do so. Among the desired outcomes the border adjustment tax legislation is intended to bring about are:

- Reducing the economic benefit of companies moving manufacturing offshore or nearshore.

- Modifying the tax structure to make it unnecessary for US companies to hold cash reserves offshore to avoid paying a 35% federal income tax.

- Bringing $2 to $3 trillion of offshore profits back onshore for increased investment in the U.S.

- Stopping corporate inversions or the practice of US companies relocating headquarters overseas to reduce their tax burden.

- Increasing exports by no longer requiring US manufacturers to show income on exported products.

- Discouraging imports by applying a 20% IMPORT TAX on products imported into the US from any and all countries of the world.

- Generating revenues over $1 trillion without significantly impacting trade, since the dollar is projected to increase in value under this legislation (though others argue the financial impact will be zero when all factors are considered).

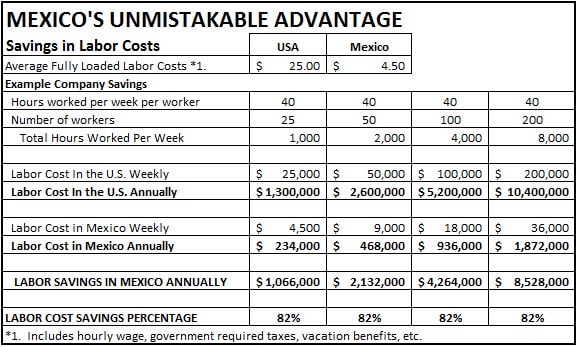

An Example of Mexico’s Unmistakable Advantage

There will be numerous debates and articles written about the pros and cons of such a tax, and whether or not it will accomplish positive impact. But for now, let us only consider whether or not such a tax would indeed be cost prohibitive for manufacturing in Mexico.

Because Mexico is able to offer US companies so many cost-reducing options, a border adjustment tax will actually not significantly reduce the net gain of manufacturing in Mexico. Among the most significant options is lower labor costs. Labor costs in Mexico are 15% to 20% of the fully loaded labor costs in the US, averaging an 82% labor savings for the average manufacturing company. This combined with reduced costs of other manufacturing functions creates an unmistakable advantage for companies manufacturing in Mexico.

EXAMPLE: The Cost of Manufacturing a Washing Machine

Consider the following real-life example of a product and what the effect would be on the bottom line of a company moving some of its manufacturing to Mexico if the proposed border adjustment tax is applied:

Let’s assume a 20% border adjustment tax is placed on all products produced in Mexico and imported into the US.

- First, it is important to note that the tax is placed on the value of the product being imported into the US and not on the final retail value of the product.

- Second, under the proposed tax regime, US companies would receive credits in their tax accounting for raw materials exported to Mexico, which could then be used to reduce the tax levied on the finished goods being imported back to the US. In effect, the border adjustment tax would only be a 20% value added tax.

- Third, such taxes are ultimately passed on to the consumer, the end buyer.

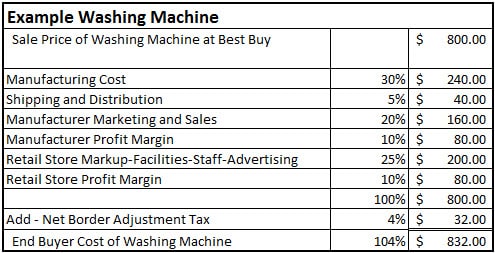

Typically, the cost of manufacturing equals approximately 30% of the final sale price. So let us consider the example of manufacturing a washing machine:

As we see in this example, the border adjustment tax of 20% would apply to the manufacturing Cost of $240, ($48.00) less an estimated CREDIT earned on exporting raw materials to Mexico ($16.00) for a $32.00 resulting border adjustment tax.

When viewed in this light, it becomes apparent that a $32 tax is a relatively small price to pay for the significant benefit of lower costs of manufacturing in Mexico. And in fact, the increase would likely be added in the form of a 4% retail price increase for the end user. Calculating the cost of the tax and weighing against the advantages Mexico offers US producers, it becomes clear that Mexico’s lower production costs wins over the proposed border adjustment tax costs. If the proposed tax is fully implemented, this one advantage alone still makes manufacturing in Mexico an attractive option for many US companies.

For information on subjects such as this our readers are encouraged to visit our blog at https://www.tecma.com.